23 February 2024

H2 Releases Q4 2023 US Sports Wagering / iGaming Market Report

Following on from the release of H2’s updated US Online Sports Market Share file – which provides all data in a flat data format, as well as providing a deeper view of promotional activity / net win – H2 has now released its Q4 2023 US Sports & iGaming market report.

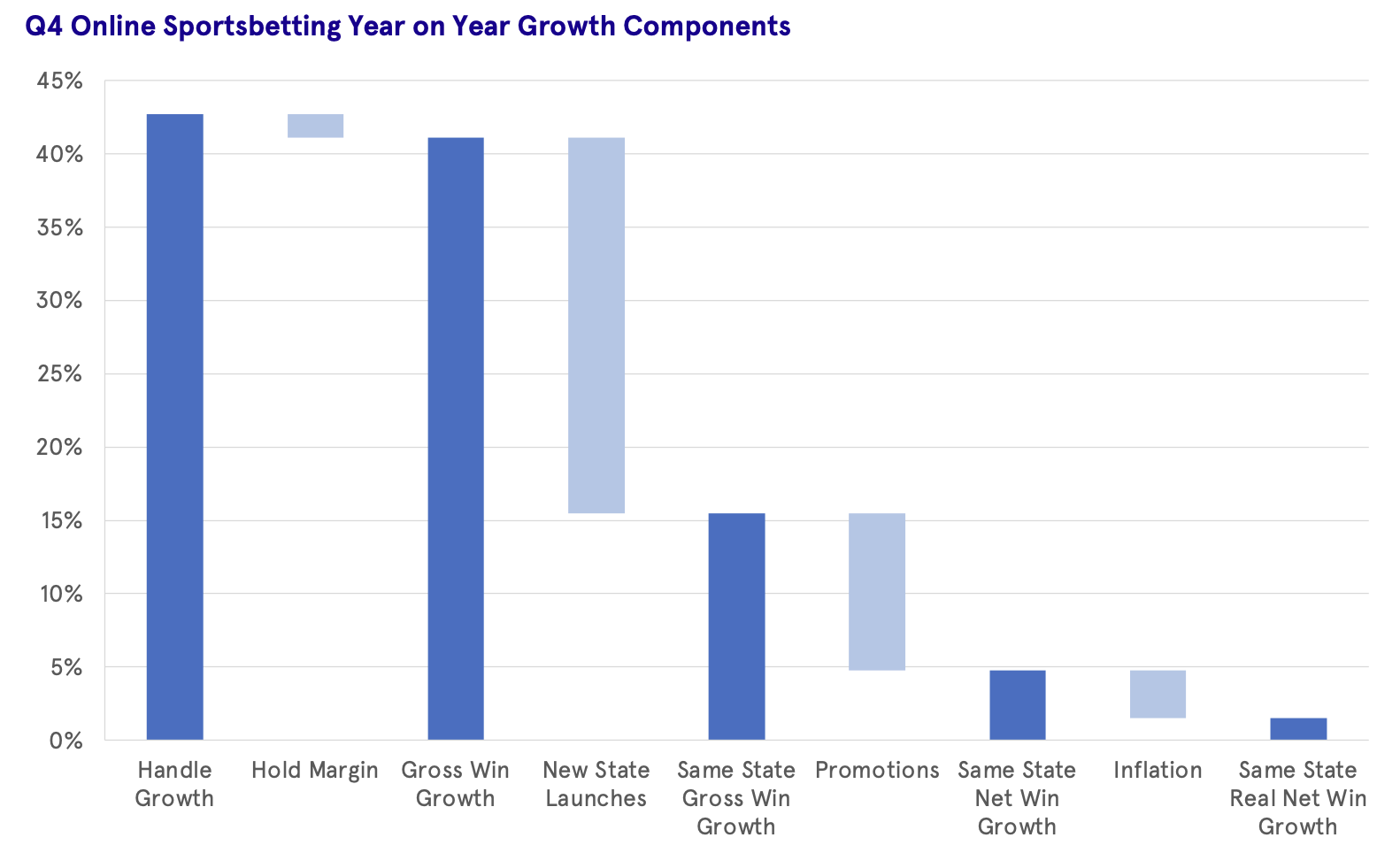

While Q4 2023 appears – at the headline level at least – to have been a very strong quarter for online sport wagering (+41% year on year handle growth to $39bn), the strong growth in handle and gross win has been driven by an increase in promotional activity (albeit a significant portion of this was driven by the launch of ESPN BET) and new state launches. H2 estimates that promotional activity has increased by 85% year on year, leading to a 20% increase in net win (operator reported revenues) rather than the headline 41% increase in gross win. Adjusting for new state launches and inflation leads to same state real net win growth of just 2% year on year in Q4.

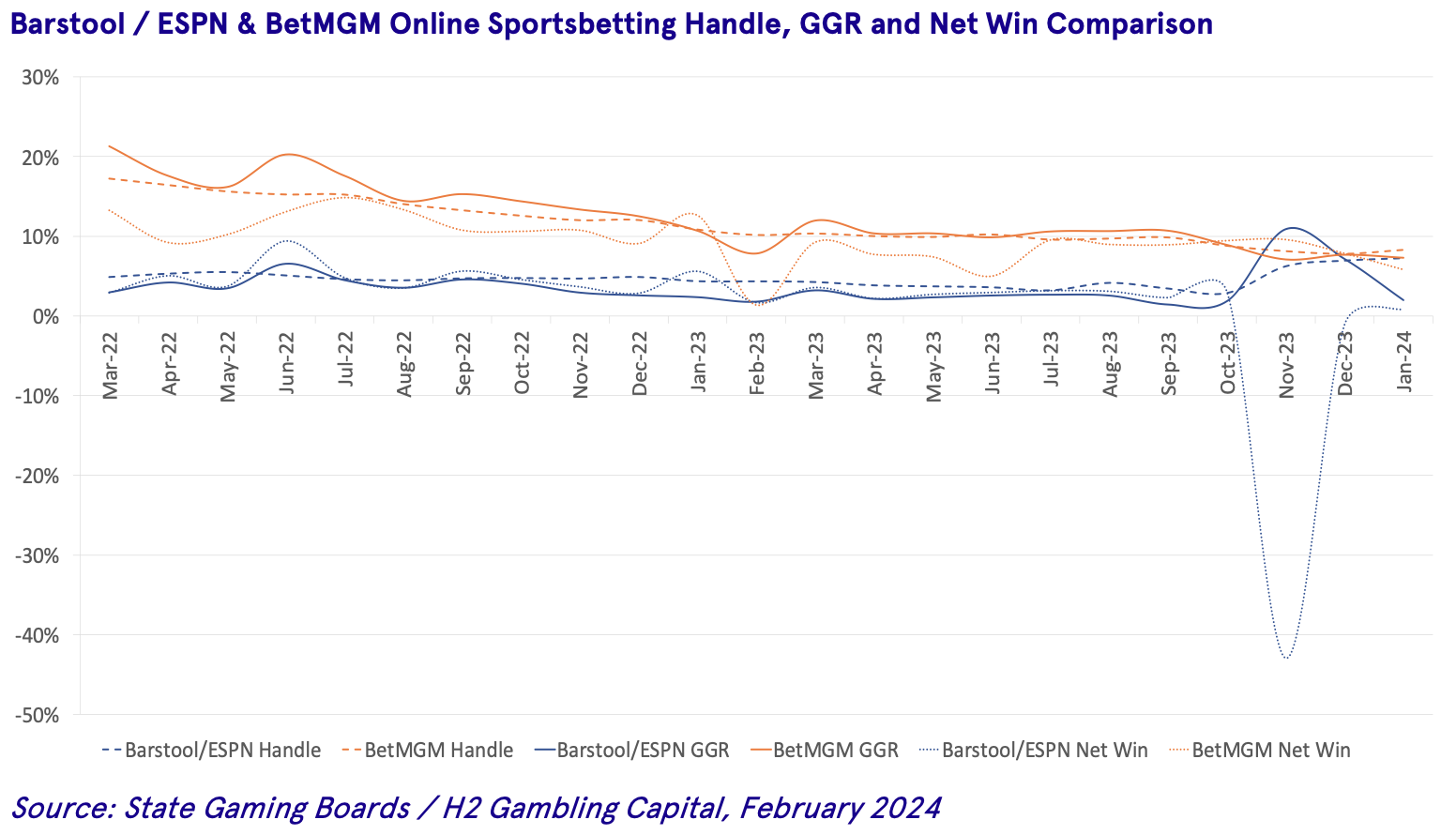

One of the headlines of Q4 has been Penn National’s launch of ESPN BET – replacing the Barstool Sportsbook. There was much fanfare about the launch, and on a headline basis, achieving a market share of c7% of handle was viewed as a success by industry commentators. However, tracking handle share is a largely meaningless analysis, with net win (operator reported revenues) the important data point – something that is included in H2’s online sports wagering market share. The significant net win losses posted by ESPN BET in November and December led to the low revenue figures posted by Penn National in Q4.

In the 10 states that report operator net win, ESPN BET generated 5% of handle, 5% of gross win but a -6% share of net win. Comparing this to BetMGM’s 7% of handle, 7% of gross win and 8% of net win shows a true picture of the underlying performance of the two operators. FanDuel remains the market leader with 52% of net win, although DraftKings closed the gap with 41% of net win.

A handful of states have now reported data on Super Bowl wagering. The three largest states, Nevada, New York and New Jersey reported combined gross win of $489m – up 27% year on year – and exactly in-line with H2’s estimate of $489m for these markets. However, Pennsylvania saw a 15% year on year decline in Super Bowl handle, which was more than H2 had anticipated, while Kentucky and Kansas both reported slightly weaker data than H2 forecast. In total, the 8 states that have reported Super Bowl handle so far have reported total handle of $657m – which is 2.8% below H2’s estimates for these states, which represent just under 50% of the total expected market wagering. This implies total market handle of c$1.32bn – up c20% year on year.

iGaming gross win of $1.79bn in Q3 is up 21% year on year, and unlike sports wagering, this has been driven by organic market growth, with no new state launches inflating the headline figures – or c.18% in real terms when taking into account inflation. For the full year, iGaming generated gross win of $6,537m – up 22% year on year – with all of this organic growth. In fact, every major iGaming state generated record high gross win in November 2023, and then broke this again in December. In Q4, iGaming reached a new high of annualised gross win per adult (in states where it is legal) of $230 per adult ($257 excluding Nevada / Delaware) – over double the $114 for sports wagering.

For more details on H2's US monthly market share and quarterly reports please contact companies@h2gc.com

About H2 Gambling Capital

H2 - a global specialist gambling sector market data provider based in the UK - is widely recognised as the leading independent authority regarding market forecasting and intelligence on the gambling industry. The intelligence generated by H2’s industry forecasting model has become the most quoted source regarding the sector in published company reports, transaction documentation and sell-side analysts’ notes, as well as in the trade/business media. Its detailed coverage extends to over 150 national/state gambling markets and 100 listed operators and suppliers.