05 January 2024

Global Gambling Industry Generates $536bn in 2023 with H2 Expecting 7% Growth Expected in 2024

H2 Reviews the Global Gambling Market Performance in 2023 and Sets Out Expectations for 2024

The start of a new quarter sees H2 update all exchange rates in our model to reflect the end of Q4 2023 metrics. In addition to detailing the impact of our final exchange rate up date of 2023 we provide our post end of the calendar year assessment of the global gambling market / set out our 2024 industry growth expectations.

By the end of the calendar year, we already have actual data in respect for as much as 65% of the total expected value by way of monthly / quarterly company / regulator reporting. This includes at least some, and in most cases the majority of, data for all the ten largest national markets and for 17 of the top 20.

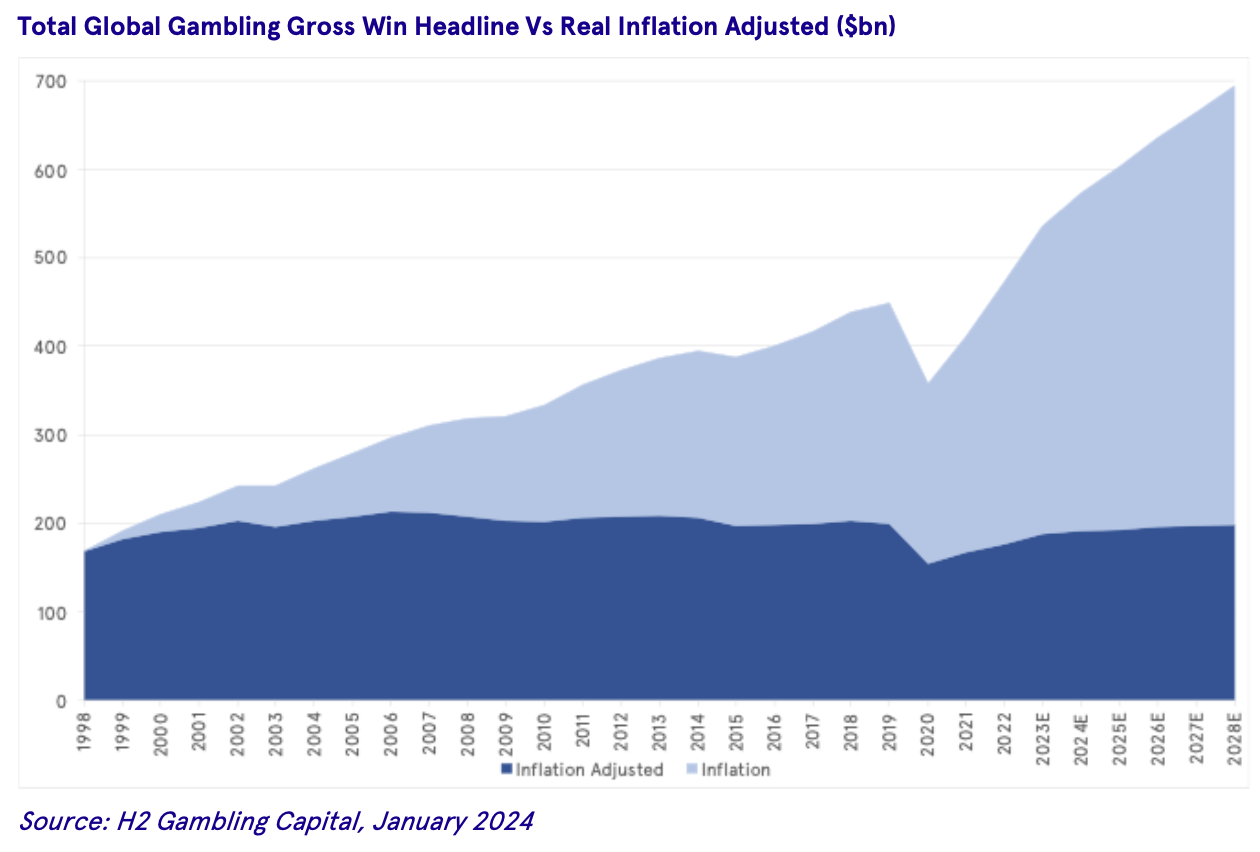

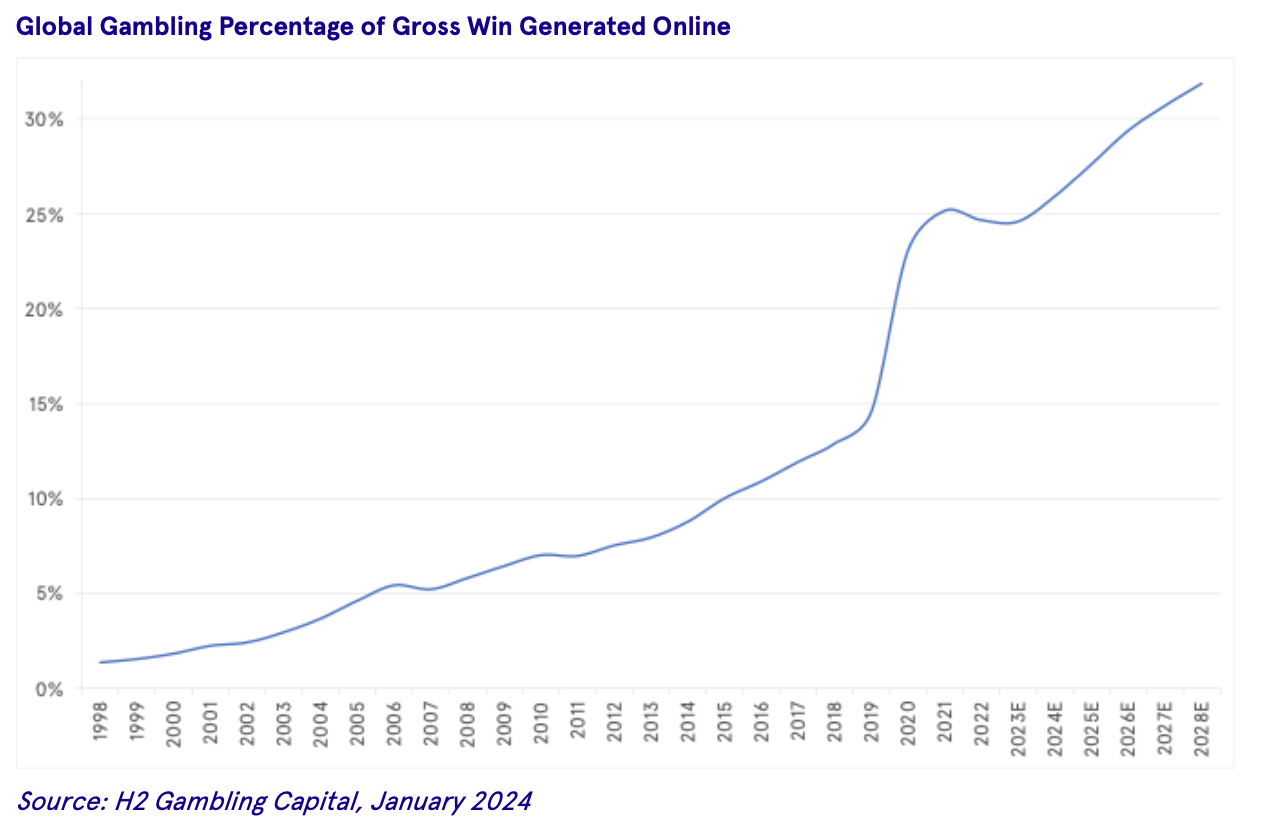

We begin the new year expecting 2023 to have generated a total of c$536bn in global gross win for the regulated (white / grey) gambling industry, with c24.6% of this via the online channel. This would equate to a YoY headline increase of 13.1% / a real inflation adjusted advance of 6.4%.

Online saw its global gross win increase by 12.8% headline / 6.0% real inflation adjusted to a record c$132bn as its share of the total market reaming virtually the same at 24.6% despite land-based activity being virtually fully available.

Global land-based gambling gross win was up 13.3% headline / 6.5% real inflation adjusted to return an expected record global gross win of c$404bn. However, it should be noted that although this is 5.4% greater than its pre-pandemic 2019 level in headline terms once inflation is factored in this would equate to a real terms 16.8% fall over the past four years and is still nearly 30% below the inflation adjusted pre-GFC levels seen in 2006 / 2007.

As we enter 2024, we also provide an assessment of the year to come. We expect overall growth for the sector to slow to c7.0% during the year though this is still expected to be c1.8% ahead of inflation. This would take the total gross win generated by the global gambling industry to c$573bn.

The online market, which we had expected to see its share step back to c23.8% at the beginning of the year, continued to slightly outperform expectations during the first full year of reopened land-based operations. 2023’s online global industry online penetration rate of 24.6% would seem to suggest many customers have continued to consume more of their gambling online after the pandemic.

In 2020 online only accounted for 14.5% of total global gambling. This period has seen the absolute size of the market double in headline terms, and it is almost 60% larger in real terms even once the impact of inflation is considered.

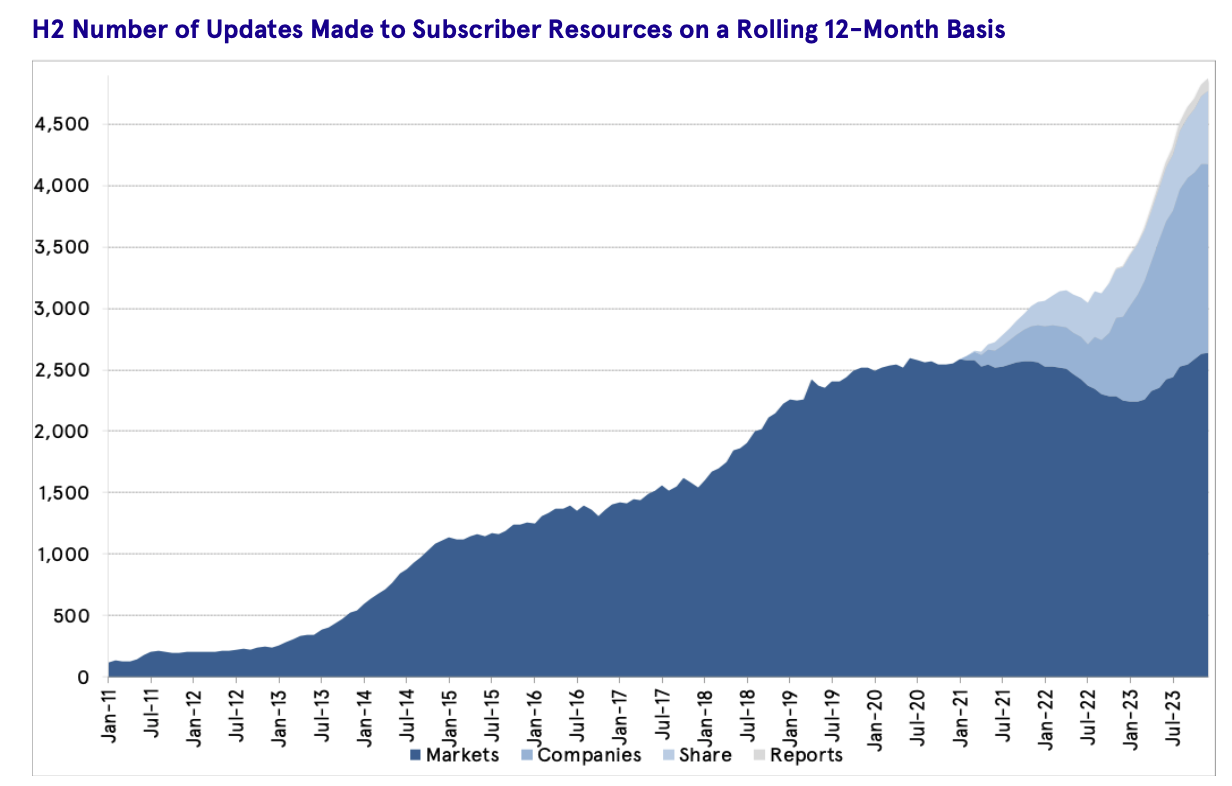

In 2023 H2 posted a total of 4,873 updates in our subscriber area, up 45.7% on the 2022 level. Going forward we continue to update our models as and when data / relevant news flow is published. All of this will be documented in our weekly newsletter, monthly industry comment reports alongside each of the market datasets in the subscriber area. We are aiming to provide more than 5,000 updates in the year ahead / enhance our Plus Reports Tier and continue to enhance how users can consume our data.

This is an extract from H2's global analysis note published for subscribers on 04 January 2024. For further details regarding H2’s subscriptions contact Josh Hodgson josh.hodgson@h2gc.com .